- November 24, 2023

Every index investor is a quant investor and here’s why

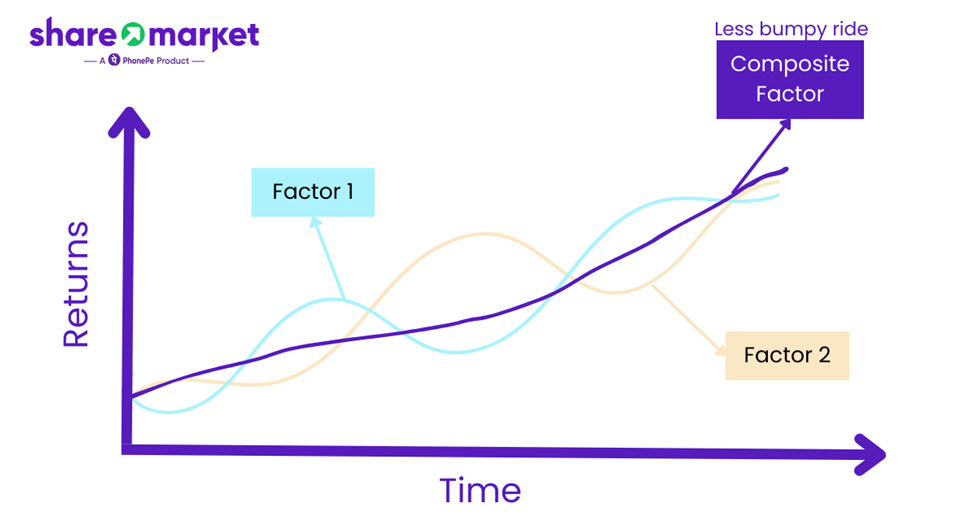

No single factor excels in market cycle; some thrive in bull runs, while others perform during market crashes.

When you first step into the realm of investing, you’ll frequently hear about the virtues of index funds. Wise investors often cite legendary figures like Warren Buffett, praising the merits of these funds.

As a result, you may find yourself holding a well-known index fund in your portfolio, perhaps the Nifty 50 or Sensex 30.

But, here’s a little-known secret: these indices are, at their core, a form of factor investing. How so, you ask? Well, let’s break it down in plain language.

These indices consist of India’s top 30 or 50 companies in the stock market, selected based on their market value. When a company’s stock price rises and its market value grows, it joins the index. Conversely, if a company’s market value stagnates or declines because of price fall, it is shown the exit door.

Every six months, these constituents are re-evaluated, and significant amounts of money are poured into these companies through Exchange-Traded Funds (ETFs) or index funds.

Now, let’s pivot to the realm of factor investing, which looks at specific factors or characteristics that historically have been associated with higher returns.

These characteristics can be factors like Value, Yield, Quality, and more. One such widely known factor is “Momentum,” which looks at the relationship between a company’s recent price performance and its future expected returns. The momentum effect says that past winners will outperform the past laggards.

If we revisit our discussion about Nifty 50 and Sensex 30, we’ll realize that these market-cap based indices exhibit momentum-like behavior.

As the index constituents display price strength, i.e, showing positive momentum, their price starts increasing and so does their market capitalization. This increases the constituent’s weight in the overall index. The reverse is also true. Therefore, every market-cap index has in effect momentum investing embedded in it.

But there’s a catch. Not every factor consistently performs well across all market cycles. Some do well during bull runs while others do well during market crashes.

What if there were index-like portfolios designed with a set of factors that consistently delivered rewards to investors with relatively lower risks?

This is what practitioners of factor investing aim to do. While building portfolios, approach is to invest by combining the traits of all successfully tested factors into creating a “composite factor”.

This composite factor gives exposure to all factors, making investing journey less bumpy.

The below image explains this better.

But this is not as easy and simple as it sounds. This involves running millions of calculations, across thousands of data points on all the 3000+ stocks listed in the country.

These calculations help in answering two questions for quant models:

Which factors should be included?

What weightage should each factor be given?

This is just like a Michelin star chef choosing the right ingredients in the right quantity to cook their customers, a lip-smacking cuisine.

And just like star chefs, we keep experimenting with our ingredients so that our dishes remain relevant and keep up with the ever-changing tastes of consumers.

But, once created, the machine takes control of the driving seat, and all the decisions are on auto-pilot mode. There is no human intervention, just like an index, immunizing such strategies from behavioral biases that hurt portfolio returns.

And there is no dearth of studies done by academicians and portfolio managers validating our claims of behavioral biases hampering the returns of a portfolio.

So, in short, factor investors follow a simple process of creating their own indices using custom formulas to suit their investment objectives and then let their math machine-curated portfolios do the magic.

Sujit Modi, Chief Investment Officer (CIO), Share.Market (PhonePe Wealth), penned this piece for Business Today.

Views are personal and do not represent the stand of this publication.