- April 20, 2023

ChatGPT: Revolutionizing the future of finance

Mr. Jha writes on how the revolutionary ChatGPT will prove to be a powerful tool for finance teams.

ChatGPT, also known as “Chat Generative Pre-trained Transformer,” has become the latest sensation in the field of Artificial Intelligence (AI). Despite the existence of AI tools for some time now, the introduction of ChatGPT in late 2022 has sparked widespread excitement as it has opened up new possibilities for almost everyone to benefit from AI technology.

ChatGPT, an AI language model developed by OpenAI, is capable of generating text that is nearly indistinguishable from human writing. The model is trained on an immense corpus of text data that amounts to hundreds of terabytes. It can accomplish a wide range of tasks, such as responding to questions, summarizing lengthy texts, crafting narratives, and much more. Moreover, its intuitive interface has contributed to ChatGPT’s unprecedented growth, as it garnered a staggering one million users within the first five days of its launch, making it the quickest growing internet application in history.

While examples abound of teenagers in colleges using ChatGPT to take online exams and content writers generating content in the blink of an eye, speeches running into multiple pages can also be generated in mere seconds on a myriad of topics. A veritable cookbook can now be written in just a few days, among many other possibilities. The list of potential applications is seemingly infinite.

Now that we have briefly explored ChatGPT, we are left pondering an important question: how will this powerful tool impact finance function and teams?

Executives across various companies have expressed a significant level of interest in ChatGPT. In fact, a leading organization of CFOs recently conducted a survey, asking whether ChatGPT will have an impact on the financial function. Of those surveyed, 65% voted ‘Yes’, 25% voted ‘Let’s See’, and only 10% voted ‘No’.

How can ChatGPT be useful to finance professionals? There are numerous examples of responses generated by ChatGPT that can be easily utilized in various decision-making processes for finance executives. The table below provides a few examples and scenarios where ChatGPT queries can be run:

Pls help pass journal entry as per IFRS with a narrative, for instance lease entry | Write a legal contract for services | Share key micro and macroeconomic factors to take as inputs in annual budget planning exercise | Tax computations and draft replies to notices based on the given data |

Legal and compliance management | AR collections automation | Invoice automation | Cost analysis and cost reduction variables |

What are some key performance indicators that are important for financial analysis? | How can you use financial data to identify opportunities for cost savings? | What are some strategies for managing working capital? | What are some common financial ratios used in financial analysis? |

The queries listed above illustrate the type of detailed information that can be obtained from ChatGPT, which can be leveraged to make more informed and intelligent decisions. Indeed, ChatGPT can be likened to an expert consultant in its ability to provide valuable insights. On a lighter note, one might wonder if the jobs of human consultants are at risk, although this remains to be seen.

The information obtained from ChatGPT queries can be beneficial to finance teams in many ways, such as:

- Faster turnaround time: one can save time by automating routine tasks such as data entry, financial modelling, and report generation. This gives teams more time to focus on core activities.

- Improved efficiency: Another important benefit of ChatGPT is that it functions as a consultant, providing finance professionals with fast and accurate answers to their questions. This can lead to improved productivity and faster decision-making, which is an undeniable advantage.

- Better Insights: ChatGPT can analyze vast amounts of financial data, commonly referred to as ‘Big Data’, and provide insights that may be challenging for people to uncover. This can help identify trends and reveal strengths, weaknesses, opportunities, and threats (SWOT) that might go unnoticed using traditional methods.

- Enhanced customer Experience:ChatGPT can be a great enabler for improving customer delight by offering personalized financial advice and support. This can result in a better customer experience and increased customer satisfaction.

- Competitive Advantage: As ChatGPT-3 is a relatively new technology, finance professionals who learn to use it can gain a competitive advantage over their peers. They will be better equipped to leverage the power of AI to solve complex financial problems and provide value to their clients.

Does this mean robots are taking over again? This is a question that has been asked before, but the simple answer is ‘no’.

Will ChatGPT render many jobs in finance obsolete? Is it going to be a disruptive technology or a technology that can create new opportunities for all the people involved?

Some experts suggest that chatbots could potentially replace entire call center workforces that provide customer support in the industry. However, it is unlikely that the finance workforce will be fully replaced by AI tools like ChatGPT due to a few reasons. One reason is the fact that these tools cannot claim to be 100% error-free yet, and a human being is needed to check for the consistency and accuracy of the final advice offered by the tool.

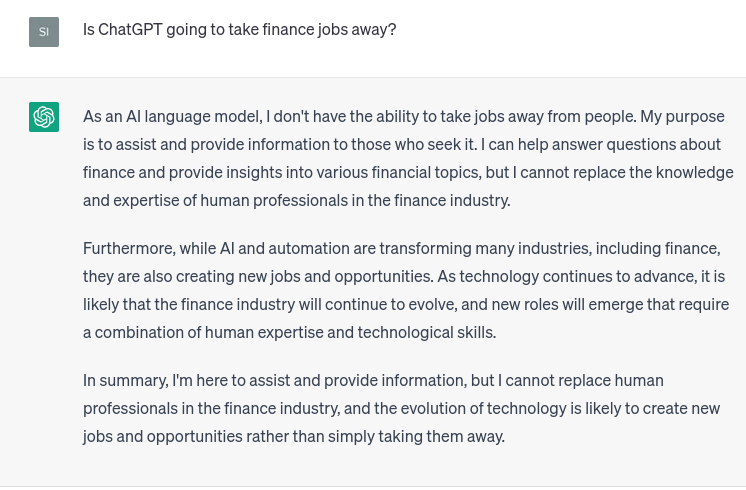

We posed a query to ChatGPT asking if it would lead to the loss of finance jobs, and its response was quite modest, as follows:

To conclude, the unlimited potential of ChatGPT is not up for debate, even if we are uncertain when we will feel its impact. As a powerful tool, it can automate routine tasks, boost productivity, and enable better data-driven decisions for finance professionals. By learning to use ChatGPT, they can stay ahead of the curve and provide more value to their clients.

While new technologies can seem threatening to people at first, recognizing their long-term value and positive impacts can aid in the smooth integration of technology into our work processes.

Meet the author:

Mr. Sanjeev Jha is the Chief Financial Officer of Persolkelly India.

Disclaimer: Please note that the views expressed in this article are solely those of the author and do not necessarily represent the opinions or views of the company. The information provided in this article is intended for informational purposes only and should not be construed as professional advice. The company does not endorse any products or services mentioned in this article. The reader should exercise their own discretion and judgment before making any decisions based on the information provided in this article.

Edited by Shivani Srivastava, Senior Editor, CFO India